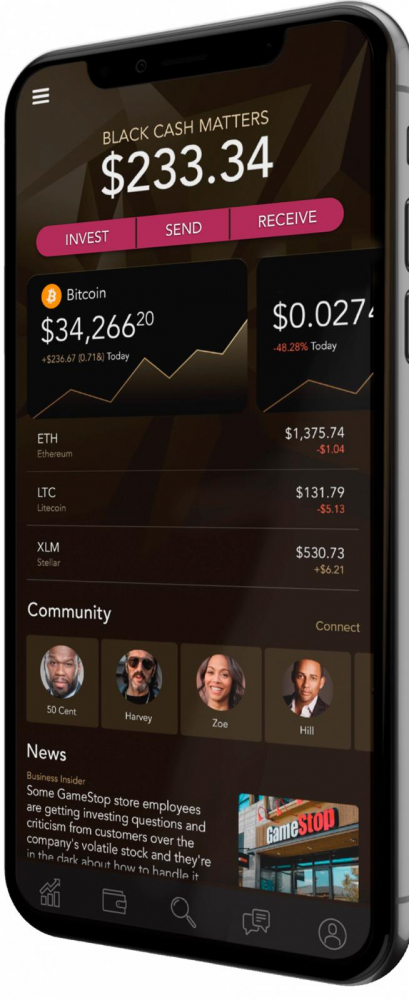

Introducing The World’s First Black-Owned Digital Wallet

Exclusive HILL HARPER Interview | Sheen Talk | Sheen Magazine | The Black Wallstreet | Naja Roberts

https://youtu.be/_RPv25Qldtg

In the middle of chaos, digitalization has always discovered a way. During the COVID-19 outbreak, technology flourished. From no physical contact to digital transactions, the term of the year was contactless. Digital wallets have entirely taken over in the post-pandemic era. With large brands and eCommerce businesses promoting no-contact transactions, this payment method has gained popularity among the general public. Moreover, now even tiny companies are accepting digital payments, it is easy than ever to travel cashless. Technology has been increasing with many of apps and more, just look at the top rated home automation atlanta experts has with their new technology.

Surprisingly, there have been over 779 billion digital transactions in fintech globally in2020 and this figure is forecasted to increase at a 13% annual rate in the subsequent years. As the trustworthiness of digital wallets grows by the day, it will be interesting to watch what the future of payment looks like.

In this blog, we will look at the e-wallet trends & the future of digital payments.

1. More Relying On The Cloud

Every aspect of digitalization is reliant on the cloud. Companies are likely to integrate more of their digital wallets with the cloud, even in e-wallet apps where late payments can pose problems for users. The issue of late payments is one of the most serious issues that arise in online transactions. The use of a network of distant servers can help to lessen this.

2. NFC (Near Field Communication) Based Payment To Gain Momentum

In recent years, we’ve seen an increase in transactions where you can pay with your card by simply tapping it. NFC is at the foundation of this technology, which will experience rapid growth in the next years. Because NFC delivers encrypted data to the POS device quickly. It is far more advanced than standard PIN technology. According to UK Finance, NFC-enabled contactless cards will account for 36% of all payments by 2027.

3. Voice-Activated Payments Are On The Rise

Voice-based technologies like virtual assistants have become the norm for many consumers in developed and emerging nations, as the demand for convenience grows. More apps may be integrated with the phone’s voice AI, or possibly come with their voice payment capabilities.

The consumer experience has been enhanced to a previously unreached degree as a result of this innovation. Many users around the world have grown accustomed to and rely on these devices to complete their daily duties. According to a poll, the number of people who use digital assistants will reach 1.8 billion by 2021.

Actor Hill Harper with his partner Najah Roberts Launches North America’s first Black-owned Digital Wallet and financial-capacity building technology: The Black Wall Street “We are not leaving anybody out,” said Harper. “Once you join the community text me at 918.262.4604, and I’ll text you back.” – Hill Harper For any tour dates inquiries contact: Kweisi Gharreau, National Logistics Executive/Brand Strategist, kgharreau@kgpr-la.com Sign up now to receive launch updates and how you can receive Black Wall Street points before we even launch.

Build Wealth.

Build Self.

Build Community.

The Black Wall Street App

You can’t be free if the cost of being you is too high.

https://theblackwallstreet.com

https://www.instagram.com/